The Tragic Irony of Inflation

Inflation = printing money. Period. Prices are measured in dollars. If we create too many dollars, that causes the value of the dollar to fall in terms of goods and services. This “inflation” started 18 months ago. Shortages and supply chain issues are a separate issue. (View Tweet)

3/🧵

INFLATION

“When we first started talking about inflation in 2021, I found it disconcerting that people are so quick to dismiss it”

Expected inflation = we can build into our models

Unexpected inflation = inflation coming in higher or lower than expected = deadly (View Tweet)

The Historical Response to Inflation From Countries

…That caused German prices of goods to rise rapidly, increasing the cost of operating the German government, which could not be financed by raising taxes because those taxes would be payable in the ever-falling German currency. The resulting deficit was financed by some combination of issuing bonds and simply creating more money, both increasing the supply of German mark-denominated financial assets on the market and so further reducing the currency's price. When the German people realized that their money was rapidly losing value, they tried to spend it quickly. That increased monetary velocity caused an ever-faster increase in prices, creating a vicious cycle. (View Highlight)

When debts become very large, and there is an economic downturn and the empire can no longer borrow the money necessary to repay its debts, this creates great domestic hardships and forces the country to choose between defaulting on its debts and printing a lot of new money. The country nearly always chooses to print a lot of new money, at first gradually and eventually massively. This devalues the currency and raises inflation. (Location 661)

People will riot if they can't buy what they need, forcing more money to enter circulation to sate the population. This is the equivalent of kicking the can down the road.

How the British measure inflation.

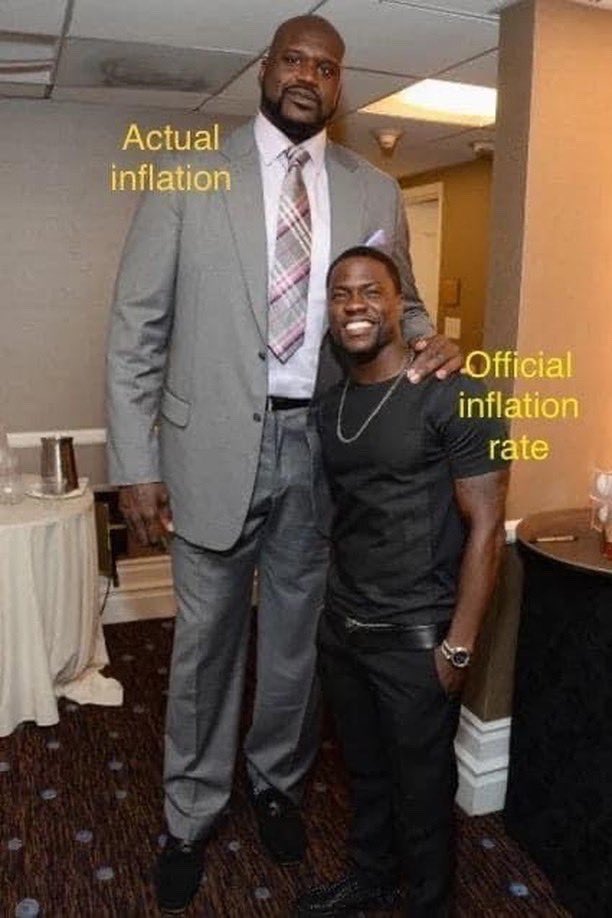

lmaoooo

California is fighting inflation with more inflation 🔥

In May 2021, after years of hyperinflation in its currency, Venezuela raised its minimum wage to 10 million bolivars a month ($22 USD). (View Highlight)

Gaslighting by Media

The media makes it seem like inflation is somehow our fault. We already know the culprits but 2008 was a big hit financially. Something we could've maybe bounced back from but the 2020 crash was another big hit we weren't ready for. That one gets underplayed for a reason. (View Tweet)

Gaslighting by Governments and Politicians

That was all well and good but, as the old phrase goes, “Who will protect us from our protectors?” The power to issue currency often proved too much for fallible rulers to enjoy without abusing. The incentives they faced to shortchange the public were powerful ones. Every time they wanted to wage a war or build a new temple or palace, the temptation to reduce the amount of precious metal that went into the coins so as to produce more of them proved hard to resist. Their subjects were not stupid, of course: they learned how to distinguish between the older and the newer coins. But it did not take long for the bad coins to drive the good coins out of circulation, as people hoarded the good ones or melted them down to obtain their relatively plentiful silver or gold. But with so much additional and debased currency in circulation, each coin came to be worth less wheat, less corn, less meat. Price inflation took hold; people found their wages and savings losing value, and the economy faltered, even throwing the entire currency into jeopardy if trust in it failed entirely. The decline of the Roman empire, for instance, was riddled with such episodes. It is therefore quite understandable that many people feel that their rulers, their government, their politicians, cannot be entrusted with such decisions, which should be kept as far away as possible from the machinations of power-hungry men—and yes, it was and remains mostly men who have stuck their snouts into the common trough. Times have thankfully changed, to some extent. Through a series of insurrections, the rule of law was imposed upon the rulers by the ruled, limiting the extent to which the king could plunder his subjects, impose taxes at will, confiscate their land, and incarcerate them when they resisted. Taxes became something much more than a levy on the poor for the further enrichment of the powerful. In response to popular movements demanding a fairer division of the surplus, taxes became a source of funding for various projects benefiting broader segments of the population. Even the rich began to realize that a welfare state was an excellent insurance policy against losing their property, their peace of mind, indeed their own heads. But the question then became: Who pays for this? As we have previously noted, the rich never like to pay the necessary taxes and the poor cannot afford to. So what then? One option, as we saw in chapter 4, was deficit-financed state expenditure—or public debt. Another was to create more money, either via the banks or via the central bank that the state instituted to fund itself and to fund the bankers in their hour of need. Both options have their demerits. Politicians dislike increases in public debt because their opponents go to town against them, accusing the government of condemning their children to a future of higher taxes in order to pay it off. One tendency, therefore, is to quietly instruct the central bank to create more money with which to pay for… (Location 1571)